Windfall of war: what does distributive justice require?

Publisher: analytical "Institute of Legislative Ideas." All rights reserved.

Authors: Tatyana Khutor, Bogdan Karnaukh, Elena Uvarova.

Project "Creation of a proper financial basis for economic stability and reconstruction of Ukraine at the expense of Russian assets and super-profits obtained through the war"

The material was prepared with the support of the International Renaissance Foundation within the framework of the project “Creating a proper financial basis for economic stability and reconstruction of Ukraine at the expense of Russian assets and excess profits obtained through the war”, implemented by the think tank “Institute of Legislative Ideas”. The material reflects the position of the authors and does not necessarily reflect the position of the International Renaissance Foundation.

Introduction

What can be considered windfall profits?

In English, apart from the neutral term 'excess profits', the term 'windfall profits' is often used to describe this economic phenomenon, which literally means 'profits brought by the wind'. The term thus implies that it refers to an unexpected benefit from something for which no effort was made. Profits are the result of a fortuitous turn of events. For an economic agent, such a turn of events is 'pure luck' - unexpected and occurring without any effort (investment) on his part. However, as history shows, what brings unexpected excessive profits to some market players, and in this sense is a 'lucky break' for them, is a disaster for everyone else and is associated with the most tragic events in modern world history. Often the wind that brings unexpected profits to a select few is the hurricane of war that devastates everyone else.

According to the International Monetary Fund, windfalls are unanticipated, fortuitous, gains typically generated by exceptional unexpected events such as wars, natural disasters, or pandemics. In this sense, the investment took place without the anticipation of the windfall profits.

Excess profits are often also explained through the concept of economic rent, which is any payment to the owner of a factor of production that exceeds the costs of bringing that factor into production. The IMF equates excess profits with economic rent. Such profits are obtained without entrepreneurial effort and labor costs. Thus, profits can be normal (which is the sum of the safe return and a risk adjustment) or supernormal (economic rent).

Who has gained windfall profits from the war in Ukraine?

The war in Ukraine has had profound negative consequences for the global economy, exacerbated by the fact that the start of the full-scale invasion came at a time when the world was trying to recover from the COVID-19 pandemic. The war has disrupted supply chains and increased inflation. Prices for critical goods, including food and energy, skyrocketed. This has led to a global crisis driven by rising costs of living, which has particularly affected the poorest and increased the risk of hunger. The war has had a significant impact on global food security. In 2022, a record number of people faced a food crisis. Energy prices rose sharply, leading to further inflation in the production, storage, and transportation chains.

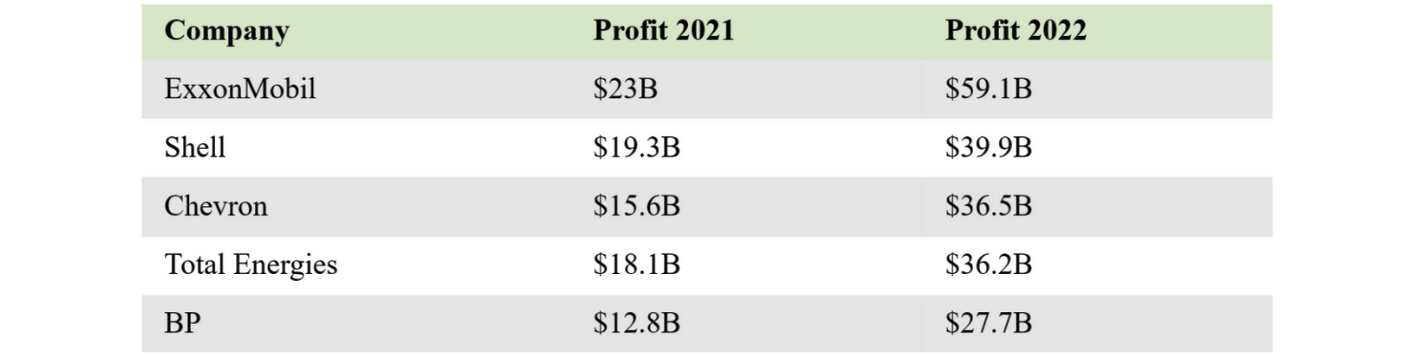

However, against the backdrop of the food and energy crises caused by the war, disruption of supply chains, rising inflation, and higher living costs for average people, some companies have, by contrast, made unprecedented profits due to the war. First of all, this applies to companies in the energy sector, and in particular to global oil giants.

In 2022, the five largest oil companies - ExxonMobil, Chevron, Shell, BP, and TotalEnergies - more than doubled their profits compared to the previous year, earning a record $200 billion in total for the year.

These excess profits were a direct consequence of the war in Ukraine: the disruption of supply chains caused by the Russian invasion and subsequent sanctions imposed by Western partners led to an increase in the price of oil from $70 to $140 per barrel in March 2022.

Similar trends were observed in the gas market. Thus, amid a sharp rise in European natural gas prices, the Norwegian company Equinor, which became the largest gas supplier in Europe after Russia's Gazprom cut supplies in retaliation for supporting Ukraine, reported in February 2023 that its adjusted operating profit doubled in 2022 to $74.9 billion.

Joe Biden, President of the United States, emphasized:

“Oil companies’ record profits today are not because they’re doing something new or innovative. Their profits are a windfall of war — the windfall from the brutal conflict that’s ravaging Ukraine and hurting tens of millions of people around the globe.”

Thus, these excessive profits of oil and gas companies do not come from their investments in production or the development of new technologies, but rather from the current market situation due to the war in Ukraine and the aggressor state's use of its natural resources (oil and gas) as a weapon and means of pressure on Western countries.

Chapter І

Taxation of windfall profits: history and objectives

The fact that some companies are strikingly enriched amid global crises and, in fact, precisely because of such crises, made economists think of the need to reallocate excess profits for reasons of distributive justice and to ensure a more even distribution of the consequences of global disasters. During the last century, taxes on excess profits were introduced primarily in response to two world wars. Thus, at the beginning of the First World War, 22 countries introduced some form of excess profits tax.

One of the first such taxes was introduced in Denmark. It was known as the 'stew tax' (Gulasch) because it applied to food exporters to Germany who were granted exclusive permission to trade with Germany. It was determined on the basis of the average profitability for the three years before the war, or on the basis of a 5 percent return on assets. It had a progressive rate structure ranging from 8 to 20 percent. A similar example was the excess profits tax in the UK in 1918-1926. The tax amounted to 80 percent of the amount of profit that exceeded the 'pre-war profit standard'.

During the Second World War, US President Franklin D. Roosevelt justified the introduction of the excess profits tax with the following words:

“Our present emergency and a common sense of decency make it imperative that no new group of war millionaires shall come into being in this nation as a result of the struggles aboard. The American people will not relish the idea of an American citizen growing rich and fat in an emergency of blood and slaughter and human suffering.”

During the Second World War, the purpose of the tax was to 'extract war profits'. It was intended for both direct and indirect profits resulting from the war, and the tax rate reached 95% (while normal profits not caused by the war continued to be taxed at the normal rate).

Another example is the 1973 oil crisis, when OPEC countries declared an oil embargo on countries that supported Israel in the 1973 Arab-Israeli war. As a result, by the end of the embargo in March 1974, the price of oil had risen by almost 300%, from $3 per barrel to almost $12 per barrel worldwide; prices in the United States were even higher. In order to redistribute the huge profits made by oil companies, the Crude Oil Windfall Profit Tax Act was passed in 1980.

In 1981, Margaret Thatcher supported the introduction of a tax on excess profits for clearing banks that had made significant profits during the recession due to high interest rates.

In general, the history of the last century has many examples of taxation of excess profits. And they all have one thing in common: such profits were not earned by companies in a particular sector and were a 'side effect' of global or regional crises and disasters. The need to redistribute them was dictated by considerations of distributive justice in order to deal with the immediate consequences of the respective crises and disasters that made these profits possible.

The Study on the Efficiency and Distributional Effects of the Excess Profit Tax, prepared at the request of the European Parliament's Subcommittee on Taxation, states:

“In general, the introduction of windfall profit taxes has two main objectives:

- the fiscal policy objective of covering exceptionally high public financial needs, e.g. to finance the war or expenditure measures to soften the consumer impact of higher costs of living due high inflation;

- skimming profits from certain industries that were either generated because of or during the unexpected event, e.g. wars and were, therefore, perceived as unfair. These profits should then be redirected towards the wider society”.

Chapter ІІ

Taxation of windfall profits caused by the war in Ukraine: EU

Similar to the tragedies of the last century, the war in Ukraine has forced governments to take measures to redistribute the excess profits brought by the war to certain sectors of the economy.

In September 2022, Ursula von der Leyen emphasized the need for such measures in her annual State of the Union speech:

“Major oil, gas and coal companies are also making huge profits. So they have to pay a fair share – they have to give a crisis contribution.”

As a result, in October of the same year, the EU Council Regulation (EU) 2022/1854 on emergency intervention to address high energy prices was adopted.

Among other measures, this regulation introduced a specific form of taxation of excess profits called the 'temporary solidarity contribution'.

The provisions on temporary solidarity contribution apply to companies operating in the following sectors of the economy: crude oil, natural gas, coal and oil refining.

The tax base (excess profits) is calculated as the taxable profits of fiscal year 2022 or 2023 that are more than 20% higher than the average taxable profits determined in accordance with national law for the four preceding fiscal years starting from January 1, 2018 (Article 15). The contribution rate must be at least 33% and is levied in addition to all other applicable taxes and fees (Article 16).

Article 17 of the Regulation defines the purposes for which the Member States may use the funds accumulated from the payment of the temporary solidarity contribution. These purposes include:

- financial support measures for final energy customers, and in particular vulnerable households, to mitigate the effects of high energy prices, in a targeted manner;

- financial support measures to help reducing the energy consumption such as through demand reduction auctions or tender schemes, lowering the energy purchase costs of final energy customers for certain volumes of consumption, promoting investments by final energy customers into renewables, structural energy efficiency investments or other decarbonisation technologies;

- financial support measures to support companies in energy intensive industries provided that they are made conditional upon investments into renewable energies, energy efficiency or other decarbonisation technologies;

- financial support measures to develop the energy autonomy, in particular investments in line with the REPowerEU objectives set in the REPowerEU Plan and in the REPowerEU Joint European Action such as projects with a cross-border dimension;

- in a spirit of solidarity between Member States, Member States may assign a share of the proceeds of the temporary solidarity contribution to the common financing of measures to reduce the harmful effects of the energy crisis, including support for protecting employment and the reskilling and upskilling of the workforce, or to promote investments in energy efficiency and renewable energy, including in cross-border projects, and in the Union renewable energy financing mechanism provided for in Article 33 of Regulation (EU) 2018/1999 of the European Parliament and of the Council”.

Taxation of windfall profits caused by the war in Ukraine: United Kingdom

In 2022, the UK adopted the Energy (Oil and Gas) Profits Levy Act. This law introduces an additional 25% "surcharge" to the existing tax burden of oil and gas companies.

Currently, the oil and gas sector pays income tax at a basic rate of 40%, consisting of 30% corporate income tax and 10% additional levy. Thus, with the introduction of the excess profits tax, the total rate will be 65%. The tax is expected to raise around GBP 5 billion in the first 12 months of its implementation. The special tax came into force on May 26, 2022. Six months later, the rate was increased from 25 to 35%.

In the first tax year when the tax was in place, 2022-2023, it brought £2.6 billion against a £5 billion forecast, according to BBC News.

In March 2024 UK Chancellor Jeremy Hunt has extended the tax until March 2029.

However, the Government earlier announced that the tax would be abolished if oil and gas prices fall below a certain level for six months. For this to happen, average oil prices must fall to USD 71.40 per barrel and gas prices to GBP 0.54 per term for two consecutive quarters.

Taxation of windfall profits caused by the war in Ukraine: USA

In October 2022, President Joe Biden announced his intention to introduce taxation of excess profits of large oil companies. In February 2023, the Senate introduced a corresponding bill (Big Oil Windfall Profits Tax Act).

According to this draft law, a special tax will be levied only on the largest companies that produce or import at least 300,000 barrels of oil per day. Smaller companies, which account for about 70 percent of U.S. production, would be exempt from the tax.

The tax rate will be calculated as 50 percent of the difference between the current price of a barrel of oil and the average price of a barrel before the pandemic in the period from 2015 to 2019. This tax will be paid quarterly. It will be applied to both U.S. and imported oil to ensure a level playing field. The tax will be applied to profits from oil sales in 2022 and beyond.

The revenues generated by this tax will be transferred back to consumers in the form of an annual refund. At oil prices of about $90-100 per barrel, this tax could bring in about $48.1 billion a year.

However, according to experts, the chances of this draft law being passed are extremely small, given that the Senate is now divided equally, and Democrats' attempts to introduce a tax on excess profits of oil companies have not yielded results for ten years.

Taxation of windfall profits caused by the war in Ukraine: Taxation of windfall profits caused by the war in Ukraine: Ukraine

Ukraine

In Ukraine, a tax on excess profits will be applied to the banking sector. Banks' excess profits were driven by the NBU's June 2022 increase in the discount rate from 10% to 25%. As a result, in the first five months of 2023, the system's interest income was 51% higher than in the same period last year.

In addition, most of the sector's income comes from the government, as it receives interest payments on government bonds issued by the Ministry of Finance and NBU certificates of deposit. In May, these sources provided banks with 53% of total interest income, according to the NBU's June Financial Stability Report.

In view of the above, the Finance Committee of the Verkhovna Rada of Ukraine has drafted a law No. 9656-d on amendments to subsection 4 of section XX "Transitional Provisions" of the Tax Code of Ukraine regarding the peculiarities of bank taxation.

The draft law initially envisaged an increase in the corporate income tax rate for banks from 18% to 36% without the right to offset losses from previous periods during 2024-2025.

The explanatory note to the Draft Law states:

"the Draft Law aims to introduce additional taxation of interest income of banks, as the increased inflationary pressure and the introduction of tighter monetary regulations have created circumstances favorable for the growth of net profits of banks, which are received by them due to changing economic conditions and do not directly result from the increase in the productivity of the banking sector. That is why such profits can be a source of additional budget revenues to achieve a more efficient distribution of the relevant "economic rent" among economic agents."

However, the draft law was amended for the second reading. The corporate income tax rate for 2023 was increased to 50%, and in subsequent years, starting in 2024, it will be 25%.

As Yaroslav Zheleznyak, Deputy Head of the Verkhovna Rada's Tax Committee, explained, "According to the Ministry of Finance's calculations, this will bring UAH 24-25 billion in 2023 alone. Then it will be 6-7 billion."

On November 21, 2023, the Draft Law was adopted in the second reading. The Law entered into force on December 08, 2023.

According to the Opendatabot portal, in 2023, Ukrainian banks generated UAH 160 billion in pre-tax profit. This is almost twice as much as before the full-scale invasion. Thus, under the new law, they will have to pay more than UAH 73 billion to the budget.

Taxation of windfall profits caused by the war in Ukraine: Taxation of windfall profits caused by the war in Ukraine: Russian Federation

Russian Federation

It is noteworthy that the aggressor state also uses windfall taxation to mitigate the budget deficit caused by the war against Ukraine. In August 2023, Putin signed a law on a tax on excess profits for large companies. The tax is scheduled to be a one-time tax, to be paid by January 28, 2024. However, the government does not rule out that such a measure may be needed again in the foreseeable future. Although the Ministry of Finance assures that the proceeds will not be used for the war, it will be impossible to track their use.

Experts note that the need for additional funds is caused by the war. In January-July 2023, the federal budget deficit amounted to 2.81 trillion rubles, or 1.8% of GDP. At the same time, according to the current budget law, the deficit for the whole of 2023 should be 2.9 trillion, or 2% of GDP. Therefore, it is likely that the excess profit tax is intended to address the budget deficit.

The tax will apply only to large companies whose average profit in 2021 and 2022 exceeds RUB 1 billion. The rate is 10% of the excess profit, which is calculated as follows: the arithmetic average of profits for 2021 and 2022 minus the arithmetic average of profits in 2018 and 2019 (the covid year 2020 was excluded from the calculations). The amount must be paid by January 28, 2024. However, if paid earlier, from October 1 to November 30, 2023, the tax rate can be halved to 5%.

The Ministry of Finance predicted that two and a half thousand companies will pay the tax and expects that this will bring an additional 300 billion rubles to the aggressor's budget.

So far, according to finance minister Russia’s federal budget has received around 40 bln rubles ($453 mln) out of the planned 300 bln rubles ($3.4 bln). However, the main payment period is yet to come in November-December.

Profits of the international depository Euroclear

A separate "entry" in the discussions on the windfall taxation is the profits generated by the Belgian depository Euroclear from Russian sovereign assets that were frozen on its accounts after the full-scale invasion.

A total of €196.6 billion has been frozen on Euroclear's accounts, of which €180 billion are assets of the Central Bank of the Russian Federation and €16.6 billion are assets of private investors (likely sanctioned Russians).

The Russian securities frozen in Euroclear accounts, like any other securities, generate income (for example, dividends are accrued on shares; bonds are paid, etc.). Under normal circumstances, such income would have to be transferred to the owner of the securities (in this case, the Russian Federation and its henchmen). However, as a result of the sanctions, these revenues, as well as the assets (securities) themselves are subject to blocking, and therefore, the revenues are also sitting on Euroclear accounts.

The income received in this way qualifies as long cash balances. According to the standard procedure, which is the same for all clients, such balances are subject to reinvestment in order to minimize credit risks.

The interest earned on reinvestment of cash balances constitutes the income earned by Euroclear. And while in 2022 Euroclear reported €821 million in revenues from frozen Russian funds, in 2023 the amount of such revenues reached about €4.4 billion..

These revenues were made possible only by the war and sanctions imposed by the West against the aggressor.

And it is in relation to these excess profits of the Belgian depository that the European Union seems to have finally made up its mind to direct them to help Ukraine.

In June 2023, at a summit in Brussels, EU leaders agreed to gradually move forward with a plan to tax excess profits from immobilized Russian assets.

U.S. Treasury Secretary Janet Yellen and British Treasury Secretary Jeremy Hunt have both expressed support for the European Union's initiative.

In October of 2023, representatives of the G7, the world's seven most powerful economies, issued a joint statement at the World Bank and IMF conference in Marrakech, announcing that they would consider ways to use the funds received from frozen Russian assets to help rebuild Ukraine. The statement reads:

“We will explore how any extraordinary revenues held by private entities stemming directly from immobilized Russian sovereign assets, where those extraordinary revenues are not required to meet obligations towards Russia under applicable laws, could be directed to support Ukraine and its recovery and reconstruction in compliance with applicable laws.”

According to Politico on June 24, 2024 EU countries approved a first tranche of up to €1.4 billion in military aid for Ukraine coming from the proceeds of frozen Russian assets.

The funds won't go towards reimbursements, as usual with the UAF. Instead, they'll be used to directly buy equipment like ammunition and air defense systems, with a quarter spent on purchases from Ukrainian industries.

Conclusions

=

As of the end of 2023, according to World Bank estimates, Ukraine suffered $486 billion in losses. That was the figure the Bank estimated for the cost of reconstruction and recovery, which should ensure that the country is rebuilt to become a modern, low-carbon, disaster- and climate-resilient country that meets European Union policies and standards and addresses the country's vulnerabilities.

However, the war is on, and Russian aggression continues to destroy Ukrainian infrastructure, devastate industry, and disrupt the financial system. According to the head of the European Investment Bank, Werner Hoyer, Ukraine may need up to 1 trillion euros ($1.1 trillion) in external assistance to repair the damage caused by the Russian invasion.

Against the backdrop of such unimaginable losses, some private companies are making excessive profits, and they are making them precisely because of the war and the geopolitical and macroeconomic processes associated with it. The principles of distributive justice, in our opinion, require that the economic consequences of this war be distributed more evenly. And Ukraine, as a victim of armed aggression, has the right to expect redistribution of the excess profits brought by the war in its favor to mitigate the catastrophic destructive consequences of the war. And although the partner countries are ready to transfer a portion of their excess profits to Ukraine, unfortunately, this portion can only cover a very small fraction of the damage caused. The Belgian depository's profits from reinvestment of Russian funds can bring in only 3-5 billion euros annually, while the damage done to Ukraine is already estimated at a trillion. Given this ratio, we should consider allocating to Ukraine at least a portion of the excess profits generated in other sectors of the economy, especially the energy sector. In addition, a comparison of the amount of damage caused by the war and the funds that partner countries are potentially able to accumulate through tax mechanisms should give a new impetus to discussions about the confiscation of Russian assets themselves (and not just the excess profits they have generated), since at the end of the day, even the sum of all Russian assets frozen worldwide is less than what Russia already owes Ukraine, having violated international law with its treacherous invasion.