Continued Operations Sanction Toll

*This analysis is published in English only

As Ukraine faces a dire financial crisis with war damages surpassing $486 billion by late 2023, its 2024 defense budget of $40 billion remains inadequate —roughly a third of Russia's much larger military budget. Meanwhile, $300 billion in frozen Russian assets compared to Russia's military spending and the $300 billion in frozen Russian assets. Western businesses operating in Russia have contributed approximately $27 billion in taxes in 2023, undermining aid efforts and increasing the financial burden on Western taxpayers.

This paper proposes a two-step policy to address these issues. First, it recommends mandatory financial disclosures for Western companies with Russian ties to enhance transparency and accountability. Second, it suggests a “Continued Operations Sanction Toll” (COST) on firms remaining in Russia after February 24, 2025, with proceeds funding Ukraine’s defense and reconstruction. These measures aim to shift the financial burden from Western taxpayers to those supporting the aggressor, promoting responsible business practices and ensuring sustainable support for Ukraine.

Authors:

Tetiana Khutor, Chairwoman of the Institute of Legislative Ideas, an independent Ukrainian legal think tank; professor of practice at George Mason University’s Schar School of Policy and Government

Yuliya Ziskina, Attorney specializing in public international law and information policy, Senior Legal Fellow at Razom for Ukraine

Mariia Panga, Researcher at Schar School of Policy and Government, George Mason University; Advisor in Economics and Finance, Institute of Legislative Ideas; Project Manager, Shelter for Life International.

Chapter І

EXECUTIVE SUMMARY

Ukraine urgently needs funding for defense, humanitarian aid, and reconstruction. By the end of 2023, the damage from Russia's war was estimated at over $486 billion. The cost of sustaining Ukraine and, therefore, ensuring the safety of NATO’s eastern flank is placed on Ukrainians and Western taxpayers, while the $300 billion of frozen Russian assets remain untouched. The threat of retaliation from Russia, such as the expropriation and nationalization of foreign companies, is one of the primary reasons for foreign businesses to pressure their respective governments against the confiscation of Russian sovereign assets.

Ukraine's 2024 budget allocates nearly $40 billion — roughly half of its total expenses — to defense. This is three times less than the Russian defense budget, but ironically roughly equal to the amount that Western companies have paid to the Russian one. International corporations that continue to operate in Russia keep financing its war machine against Ukraine by paying taxes and supporting supply chains. While 423 businesses have exited Russia, over 2,000 others voluntarily choose to remain in the aggressor’s market, continuing business as usual and thus contributing to Russia’s militarized economy.

Estimates suggest that foreign businesses paid around $27 billion in total taxes to Russia’s budget in 2023. For every $7 in bilateral aid that the G7 governments declare for Ukraine, their companies may still be paying $1 in taxes to Russia. Many of the remaining businesses in Russia are headquartered in the US and Germany.

This stands out, especially considering that the US and Germany, as major donors to Ukraine, have contributed over $99 billion in aid since the invasion. By financing Russia’s war machine, Western businesses undermine the contributions of taxpayers from their own countries who support Ukraine’s military and humanitarian efforts.

Relying solely on Western taxpayers is not a sustainable long-term solution. A creative, multifaceted approach is needed to establish long-term funding and reduce the financial burden on Western states.

As part of allied cooperation, political leaders should explore shifting the financial load to Russia and its enablers by creating an international compensation fund drawn from Russia and its enablers’ sources.

Western governments should consider implementing a two-step approach to hold accountable businesses that stay in Russia after February, 24, 2025:

- By introducing mandatory disclosures, which would require all publicly listed companies in Western countries to reveal their financial ties to Russia including taxes paid, assets and liabilities held. This transparency is vital for public awareness and may act as a deterrent against continued operations in Russia by exposing potential complicity in funding the war.

- By imposing a “Continued Operations Sanction Toll” (COST) on companies, the proceeds could be directed into a fund to support Ukraine’s defense, humanitarian relief, and reconstruction. This fund could also partially compensate Western companies for losses incurred from fully exiting Russia by that date. COST is not intended to normalize business ties with Russia but to raise the price for Western companies that sustain the economy of the aggressor state.

The proposed changes are suggested to be implemented through amending the legal framework for the Ukraine-/Russia-related Sanctions. These policies would simultaneously serve as a deterrent against acts of aggression and as an incentive for companies to exit the Russian market, while also raising funds for Ukraine. COST should be part of a broader strategy, including the implementation of special sanctions tariffs on exports and imports with Russia, which could provide a reliable source of support and recovery for Ukraine in the future.

These actions align with the overarching policy goals: encouraging responsible divestment from the Russian market, securing sustainable funding for Ukraine by shifting the financial burden to war enablers and facilitating the reconstruction of war-torn areas. The increased financial load will encourage more companies to responsibly exit the Russian market, thereby strengthening the West's negotiating position and preventing these companies from being used as bargaining chips.

Chapter ІІ

BACKGROUND

1. Ukraine’s Damages and Needs

Ukraine’s losses continue to grow rapidly, with estimates suggesting that the total will eventually reach trillions. Approximately 9.7 million Ukrainians are displaced, and 14.6 million Ukrainians are in need. National programs to help victims cover only a fraction of the damage, heavily relying on international partners’ support and often facing delays or blockages due to insufficient funding.

This year, Ukraine is facing a $43 billion financing gap according to the IMF, and the government has allocated nearly half of its total budget to defense while relying heavily on international aid to cover social expenses and humanitarian relief. The current 2025 forecast suggests a $26 billion financing gap, but the numbers could increase substantially due to the impact of the prolonged war.

2. Burden of Finance on Western and Ukrainian Taxpayers

Ukraine has lost about 29% of its GDP in 2022, forcing it to become highly dependent on support from international partners, such as the G7 countries, the World Bank, and the IMF. Countries like Denmark, Estonia, Lithuania, and Latvia have allocated more than 1% of their GDP to support Ukraine. With the total bilateral commitments of around $300 billion from its allies, Ukraine is able to keep its economy and defense running, but only barely. Ukraine’s annual budget needs for defense, urgent reconstruction, and other state expenditures are estimated at $110 billion per year. Roughly half of it is estimated to be covered with the foreign financial aid. The Ukrainian Ministry of Finance in order to boost the internally-originated budget revenues, has recently initiated efforts to raise taxes, including proposing higher military tax and stricter controls during tax inspections.

This comes as the consistency of support from Western taxpayers grows increasingly uncertain, with potential fluctuations in aid over time. But that would be far not enough given the massive scale of the war-time needs.

3. Aggressor's Funds Remain Untouched

In 2022, the G7 nations blocked approximately $300 billion of Russian state assets held within their jurisdictions. Under international law, Russia is obligated to pay for damage and injuries caused by its aggression against Ukraine. On November 14, 2022, the United Nations General Assembly formally recognized that Russia “must bear the legal consequences of all of its internationally wrongful acts, including making reparation for the injury, including any damage, caused by such acts.” Despite this, assets of the aggressor state located in Western jurisdictions are still untouched. Even the G7's historic decision to lend Ukraine $50 billion does not include utilizing the frozen assets of the aggressor country. Instead, it involves the proceeds generated from managing those assets.

4. Foreign Companies Continue to Fuel the Russia’s Economy with Billions in Taxes

Although sales of foreign companies in Russia decreased last year to $194.2 billion as companies began withdrawing from the market, they still contributed approximately $6.4 billion in profit tax solely to Russia’s budget. Particularly, the highest contributions came from companies in the finance, automotive, alcohol and tobacco sectors. Companies from the USA, Germany, and Austria together constituted 46% of all profit tax paid. Moreover, those that accounted for 61% of the profit tax, or $3.6 billion, have not indicated any plans to exit the Russian market.

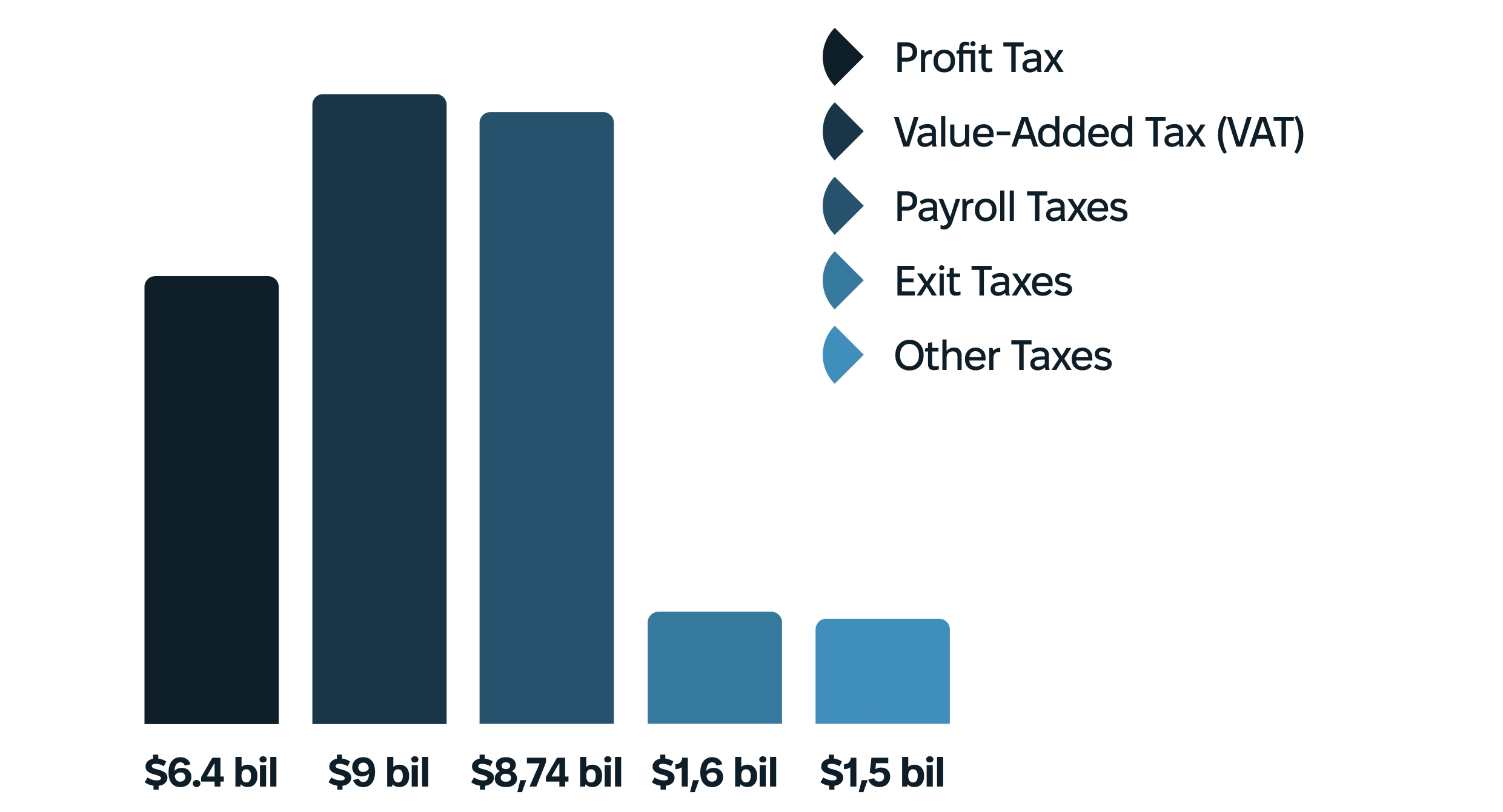

While comprehensive data for all taxes paid by foreign companies in Russia is unavailable, the following estimates provide a scale of their financial contributions in 2023:

These figures suggest that the total tax contributions of foreign companies operating in Russia reached approximately $27.2 billion in 2023. Moreover, with the corporate profit tax set to rise from 20% to 25% starting January 1, 2025, all foreign companies in Russia can expect to contribute significantly more to the country’s budget and, therefore, to the war against Ukraine.

Chapter ІІI

PROPOSED ACTIONS

1. Mandatory disclosures

A. Exposure to Russian market

Western governments should adopt policies obligating firms to disclose information on their business ties with Russia.

Disclosure should include the following information from 2021 through the latest reporting period:

- Revenues and profits generated in Russia

- Taxes paid to the Russian budget: including detailed information on federal taxes such as profit taxes, license fees, tariffs, VAT, rent for natural resource usage, and other relevant information, and employment-related taxes, including an approximation of the taxes paid by the company's employees to the Russian state; Total assets and liabilities in Russia as of the end of each reporting period;

This should be a separate reporting obligation in addition to existing annual and interim reports and material development reporting. These annual reports should be submitted to stock market regulators or to component sanctions authorities and published on companies’ websites. This approach is designed to minimize reporting costs for companies by utilizing readily available information for those operating in Russia.

At a basic fundamental level, there must be greater transparency and understanding of the scale of Western business entanglement with the Russian market. This information is particularly important for the public to know and access, as it enables a greater understanding of how their country’s businesses may be undermining the effectiveness of their taxpayer contributions to support Ukraine’s defense and humanitarian efforts. Mandatory disclosure disallows companies from obscuring their complicity in the war — thus, it may, in and of itself, act as a deterrent against continued operations in Russia. Disclosure will also allow investors and shareholders of these companies to manage multiple risks of exposure to conflict and high-risk areas.

2. COST on multinationals operating in Russia

Imposing a fee titled “COST” (Continued Operations Sanction Toll) on multinational businesses that continue business in Russia, with proceeds paid into a compensation fund, should be done under respective national laws or at a broader regional level for EU members.

Estimates show that foreign companies paid around $27 billion in total taxes to Russia’s budget in 2023. With the corporate profit tax set to increase from 20% to 25% on January 1, 2025, foreign companies in Russia can expect to contribute significantly more to the country's budget next year. With the suggested implementation of COST at 50 cents for every dollar paid to Russia, Western companies would collectively contribute an additional $6-8 billion in fees to the international compensation fund.

COST may be distributed as follows:

- 90% allocated to Ukraine’s defense, reconstruction, and reparations;

- 10% allocated towards a “business compensation fund” created to help cover the losses of businesses that have fully left the Russian market, and to further incentivize businesses to complete their exit.

Imposing these measures could not only ease the burden of funding for Ukraine and its Western supporters, but also reduce Russia’s resources for continuing the war in the long term.

Many businesses cite their potential losses as an excuse for staying in the Russian market. Allocating a small portion of COST towards a business compensation fund may undermine this excuse and further incentivize businesses to complete their exit. It may also attract companies that have already left Russia to support this campaign.

COST is not intended to normalize business ties with Russia. On the contrary, it aims to impose monetary consequences on Western companies that continue to support adversarial economies like Russia. The fee should either increase annually or follow a progressive scale, so that the longer a company supports Russia's economy, the more it must contribute to offsetting the damage funded by the taxes it pays. Ultimately, COST is designed to make doing business with Russia increasingly expensive and less attractive over time.

Chapter ІV

GOALS AND RATIONALE

Create Sustainable Funding for Ukraine’s Future

Political uncertainty about future aid to Ukraine jeopardizes its sustainability and defense against Russia. Ukraine faces urgent defense and financial needs, with widening budget gaps for military, reconstruction, and other expenditures. A defeat for Ukraine would increase the EU, US, and NATO’s costs to protect the eastern flank significantly, surpassing current aid levels. Therefore, building diverse, sustainable funding mechanisms is crucial for Ukraine’s long-term sustainability.

Increase Decision-Making Independence and Security

Western economic ties with Russia may deter assertive responses to Russian aggression. Companies with Russian interests lobby against asset seizures and sanctions, undermining Western resolve. The perception of economic leverage can embolden aggressors, making them believe the West is too dependent to impose effective consequences. Western companies benefiting from Russia hinder Ukrainian funding and block the use of frozen Russian assets. Encouraging companies to exit Russia would ease pressure on policymakers, allowing more strategic decisions.

Strengthen Negotiation

Increased taxes will encourage more companies to responsibly exit the Russian market, thereby strengthening the West's negotiating position and preventing these companies from being used as bargaining chips. With fewer companies available to be used as negotiating pawns, Russia loses an important element of its negotiating strategy. This shifts the balance of power, as the West can negotiate from a position of reduced vulnerability to such manipulative tactics.

Shift the Burden: Aggressors and Enablers Must Pay

From both moral and practical perspectives, those who commit and enable aggression should bear the costs. Russian money could be a consistent source of funding for Ukraine. Foreign firms staying in Russia act as collaborators, placing the financial burden of supporting Ukraine on governments while benefiting from the war. These companies should face financial and reputational costs to increase the effectiveness of Western aid and sanctions.

Accelerate Russia’s Isolation from the West

Russia should not benefit from Western business and markets. Private companies must recognize their role in sustaining Russia’s economy and financing the war, as business with an aggressor state should not be normalized. Current measures, like freezing Russian assets and issuing business advisories, have been insufficient. Western businesses continue operating in Russia, fueling its economy. Expanding reporting and economic tools to further isolate Russia will increase the cost of doing business in Russia and accelerate its isolation.

Undermine Russia’s Confidence and Bolster Ukraine’s

The West’s polarized discourse and delays in aid are eroding Russia’s fear of international consequences, emboldening its aggression. Attacks on vulnerable populations in Ukraine aim to destroy hope and resolve. By implementing policies that use aggressors’ own resources to fund Ukraine would undermine Russia’s confidence and boost Ukrainian morale and endurance.

Appendices

APPENDIX 1

Precedent of mandatory disclosure of exposure to foreign markets

➀ Section 1504 of U.S Dodd-Frank Wall Street Reform and Consumer Protection Act

- Description: “1504, 'Disclosure of Payments by Resource Extraction Issuers', requires resource extraction issuers to disclose payments made to a foreign government or the Federal Government for the purpose of the commercial development of oil, natural gas, or minerals. Reports must be filed annually in an interactive data format.”

- The Dodd-Frank Act has a provision requiring resource extraction issuers (e.g. mining, oil, and natural gas companies) to disclose all payments they make to foreign governments and the U.S government for the commercial development of minerals, oil, or natural gas.

- The goal of Section 1504 of the Dodd-Frank Act was to increase transparency and reduce corruption by reporting transactions made between companies and governments—and to specifically help the public and investors see how much money their governments receive from exploiting natural resources.

- Companies are required to report payments, i.e taxes, royalties, fees (including license fees), production entitlements, bonuses, and other material benefits.

- https://www.corporatecomplianceinsights.com/wp-content/uploads/2012/12/another-side-of-dodd-frank-understanding-section-1504-final.pdf

② U.S. Foreign Corrupt Practices Act (FCPA):

- Description: “The Foreign Corrupt Practices Act of 1977 is a United States federal law that prohibits U.S. citizens and entities from bribing foreign government officials to benefit their business interests.”

- The FCPA requires American companies to have detailed records of their foreign transactions; the act also mandates internal control systems within companies to prevent bribery, setting a precedent for requiring detailed reporting on foreign business activities.

- https://www.justice.gov/criminal/criminal-fraud/foreign-corrupt-practices-act

③ EU Accounting and Transparency Directives

- Description: “The new Accounting Directive, repealing the Fourth and Seventh Accounting Directives on Annual and Consolidated Accounts (78/660/EEC and 83/349/EEC) introduces a new obligation for large extractive and logging companies to report the payments they make to governments (the so called country by country reporting-CBCR). Reporting would also be carried out on a project basis, where payments have been attributed to specific projects. The Accounting Directive regulates the information provided in the financial statements of all limited liability companies which are registered in the European Economic Area (EEA).”

- Similar to Section 1504 of the Dodd-Frank Act, the EU passed the Accounting and Transparency Directives to require companies that extract large amounts of natural resources to disclose the payments they make to governments.

- These directives were primarily imposed to fight corruption and promote accountability in countries rich in natural resources.

- Companies are required to report payments such as production entitlements, royalties, dividends, and bonuses to any government worldwide if the payments exceed a certain threshold.

- https://ec.europa.eu/commission/presscorner/detail/fr/MEMO_13_541

➃ Country-by-Country Reporting (CbCR) - Organisation for Economic Co-operation and Development (OECD) BEPS Action 13

- Description: “Under BEPS Action 13, all large multinational enterprises (MNEs) are required to prepare a country-by-country (CbC) report with aggregate data on the global allocation of income, profit, taxes paid and economic activity among tax jurisdictions in which they operate. This CbC report is shared with tax administrations in these jurisdictions, for use in high level transfer pricing and BEPS risk assessments.”

- The BEPS Action 13 was implemented to give tax administrators a good idea of multinational corporations’ activity, to evaluate transfer pricing risks and other risks pertaining to Base Erosion and Profit Shifting (BEPS).

- BEPs Action 13 requires multinational corporations to report revenues, profits before tax, income tax paid, income tax accrued, stated capital, accumulated earnings, number of employees, and tangible assets in each tax jurisdiction.

- https://www.oecd.org/en/topics/sub-issues/country-by-country-reporting-for-tax-purposes.html

Precedent for fee for continued business in Russia

➀ Helms-Burton Act of 1996 (Cuba)

- Description: “The Cuban Liberty and Democratic Solidarity Act of 1996, Pub. L. 104–114, 110 Stat. 785, 22 U.S.C. §§ 6021–6091 is a United States federal law which strengthens and continues the United States embargo against Cuba.”

- The Helms-Burton Act permits penalties on American companies that do business in Cuba using property confiscated from American citizens.

- https://www.congress.gov/bill/104th-congress/house-bill/927

② U.S. Foreign Investment Risk Review Modernization Act (FIRRMA) 2018

- Description: “The Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA) expands the jurisdiction of the Committee on Foreign Investment in the United States (CFIUS) to address growing national security concerns over foreign exploitation of certain investment structures which traditionally have fallen outside of CFIUS jurisdiction. Additionally, FIRRMA modernizes CFIUS’s processes to better enable timely and effective reviews of covered transactions.”

- While the FIRRMA is not a direct fee, the act expanded the scope of transactions the Committee on Foreign Investment in the US (CFIUS) could examine; in practice, this most likely resulted in more costs for businesses engaging in foreign markets.

- “FIRRMA broadens the purview of CFIUS by explicitly adding four new types of covered transactions: (1) a purchase, lease, or concession by or to a foreign person of real estate located in proximity to sensitive government facilities; (2) “other investments” in certain U.S. businesses that afford a foreign person access to material nonpublic technical information in the possession of the U.S. business, membership on the board of directors, or other decision-making rights, other than through voting of shares; (3) any change in a foreign investor’s rights resulting in foreign control of a U.S. business or an “other investment” in certain U.S. businesses; and (4) any other transaction, transfer, agreement, or arrangement designed to circumvent CFIUS jurisdiction.”

- https://home.treasury.gov/system/files/206/Summary-of-FIRRMA.pdf

③ UK Digital Services Tax 2020

- Description: “The Digital Services Tax is set at 2% of turnover for firms whose worldwide revenues from in-scope digital activities are more than £500 million, and who derive more than £25 million of revenue from UK users.”

- The Digital Services Tax in the UK can be interpreted as a precedent for imposing fees based on operations or making profits in a specific market.

- https://publications.parliament.uk/pa/cm5803/cmselect/cmpubacc/732/report.html#:~:text=The%20Digital%20Services%20Tax%20is%20set%20at%202%25%20of%20turnover,of%20revenue%20from%20UK%20users.

➃ Iran and Libya Sanctions Act 1996

- Description: “The Iran and Libya Sanctions Act of 1996 was a 1996 act of the United States Congress that imposed economic sanctions on firms doing business with Iran and Libya.”

- This act made it more expensive for companies to invest in Iran’s and Libya’s natural resources industries, particularly the oil and gas markets; this serves as a precedent for punishing companies financially for doing business in a specific market.

- https://www.congress.gov/bill/104th-congress/house-bill/3107

APPENDIX 2

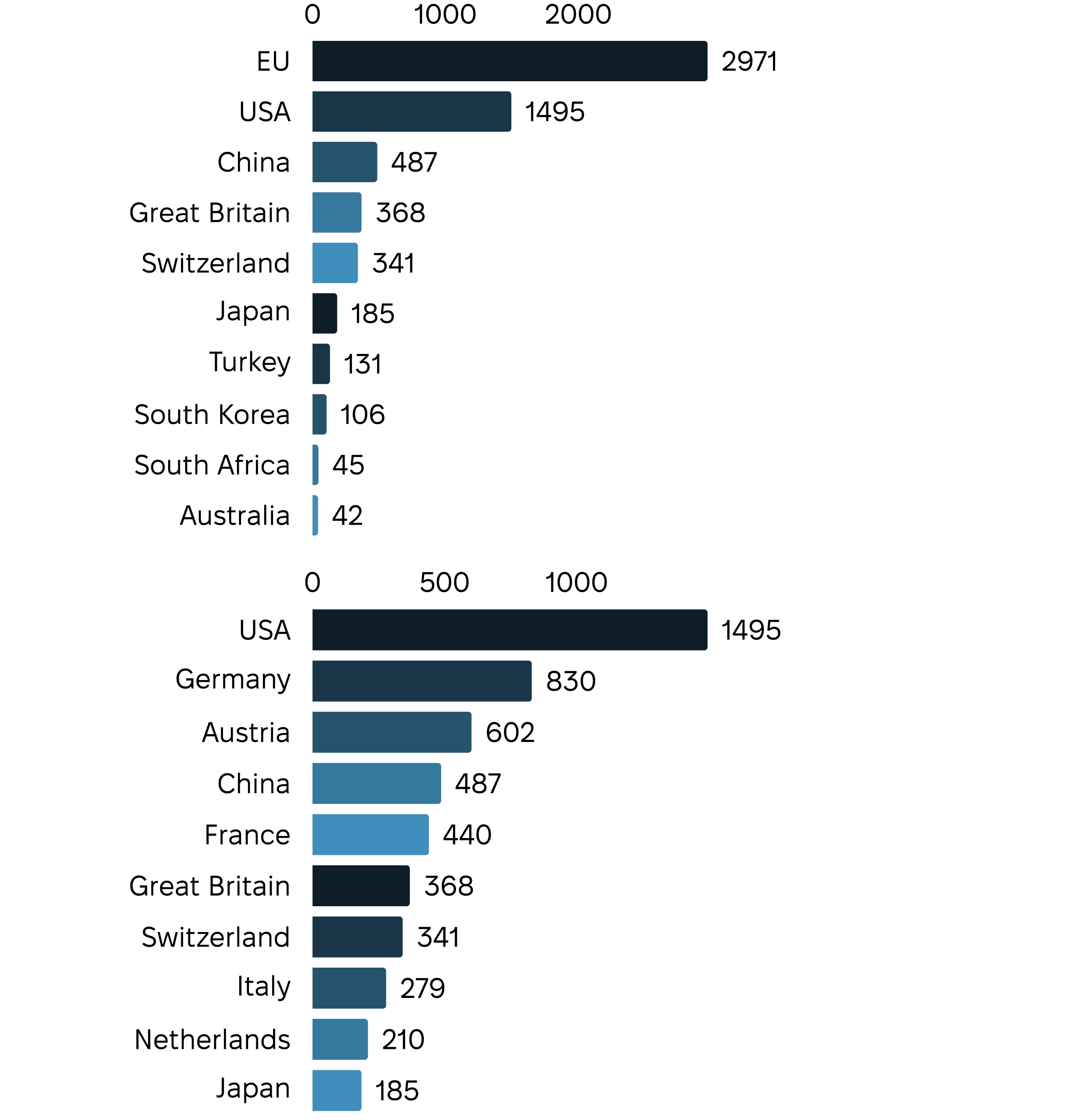

Profit Tax Paid in 2023, in $ million

Source: KSE Institute, ILI analysis

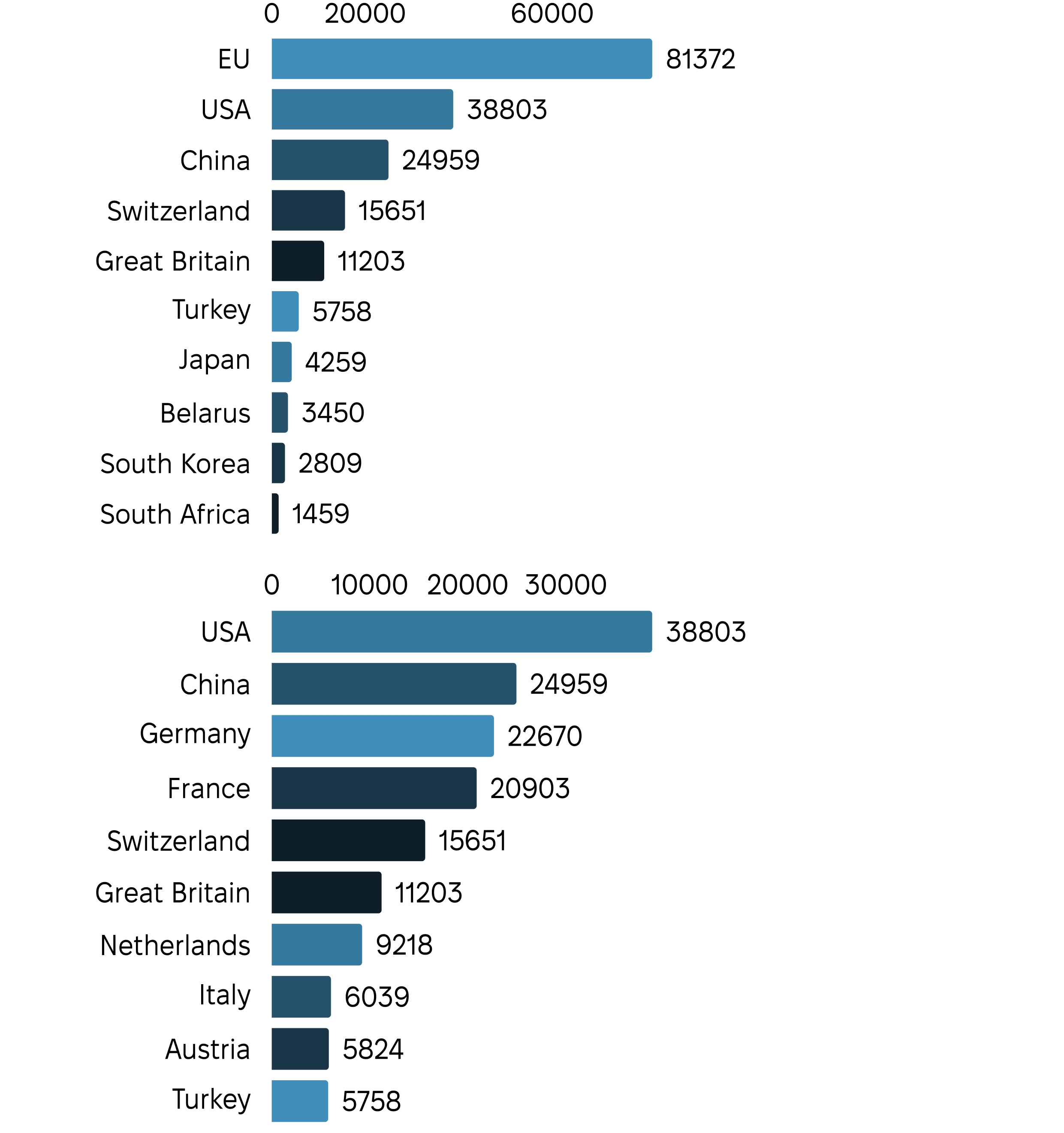

Revenue made in Russia by companies HQ, in $ million

Source: KSE Institute, ILI analysis

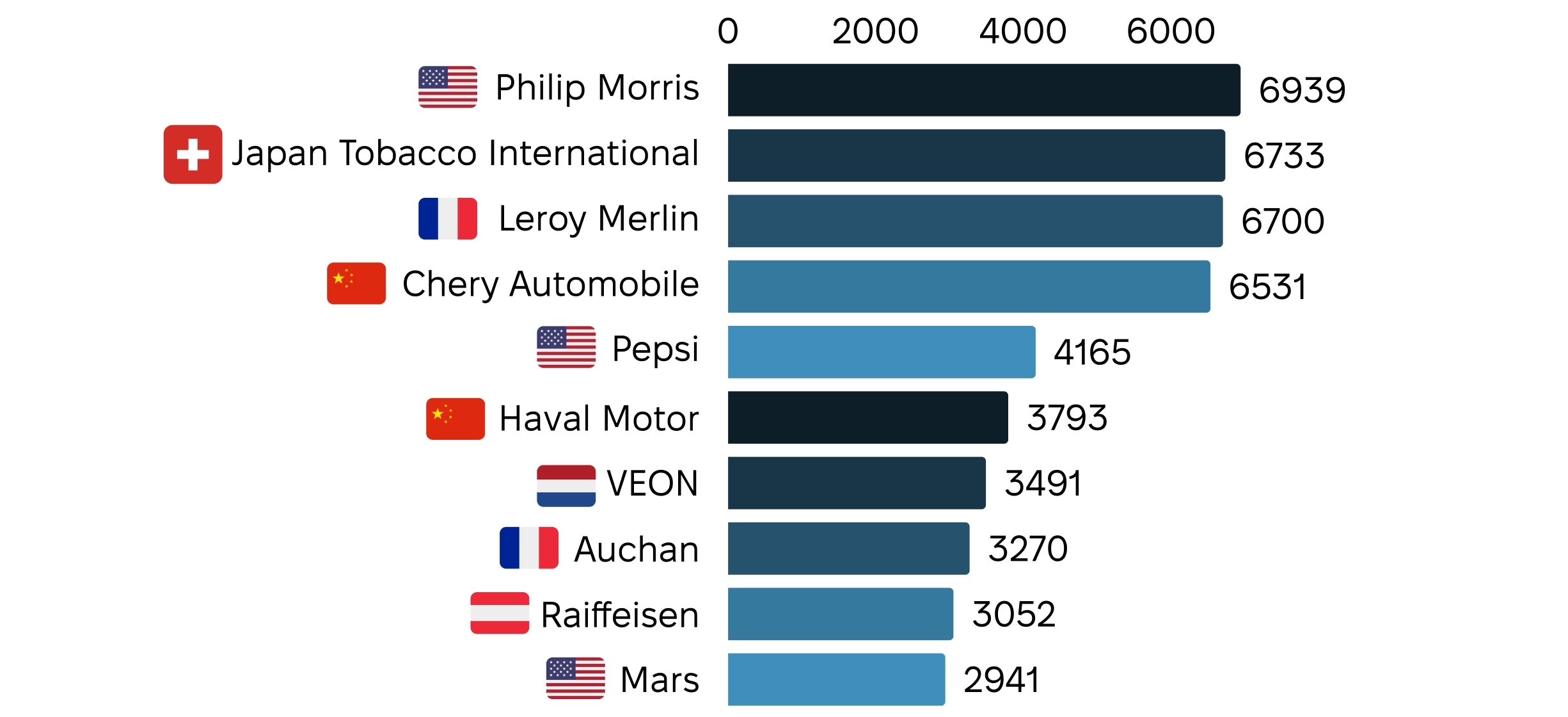

Top 10 Companies by Revenue Generated in Russia in 2023, in $ million

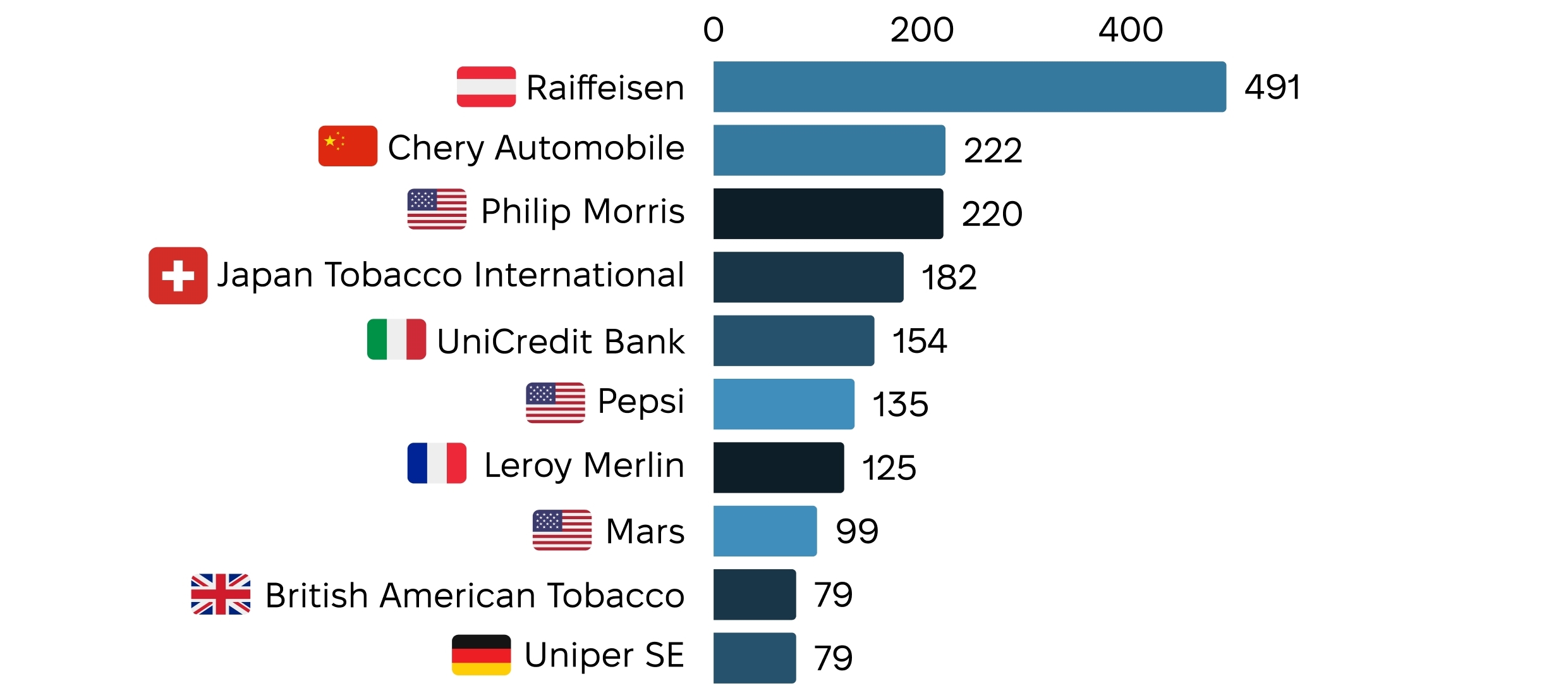

Top 10 Companies by Profit Tax Paid in Russia in 2023, in $ million

Source: KSE Institute, ILI analysis