>

Analytics>

Analysis and systematization of data on tenders for the first 100+ assets listed by ARMA on the Prozorro platformAnalysis and systematization of data on tenders for the first 100+ assets listed by ARMA on the Prozorro platform

The publication has been prepared within the framework of the project on monitoring the activities of the National Agency of Ukraine for Detection, Search, and Management of Assets Obtained from Corruption and Other Crimes (ARMA).

The Institute of Legislative Ideas focuses on the practical aspects of transferring seized assets into management, particularly for the purpose of their subsequent liquidation. The analysis covers the types of assets transferred for management, typical issues that arise at various stages of this process, as well as systemic factors that hinder effective management. Based on the monitoring results, proposals have been formulated to improve the relevant procedures and regulatory framework.

Summary

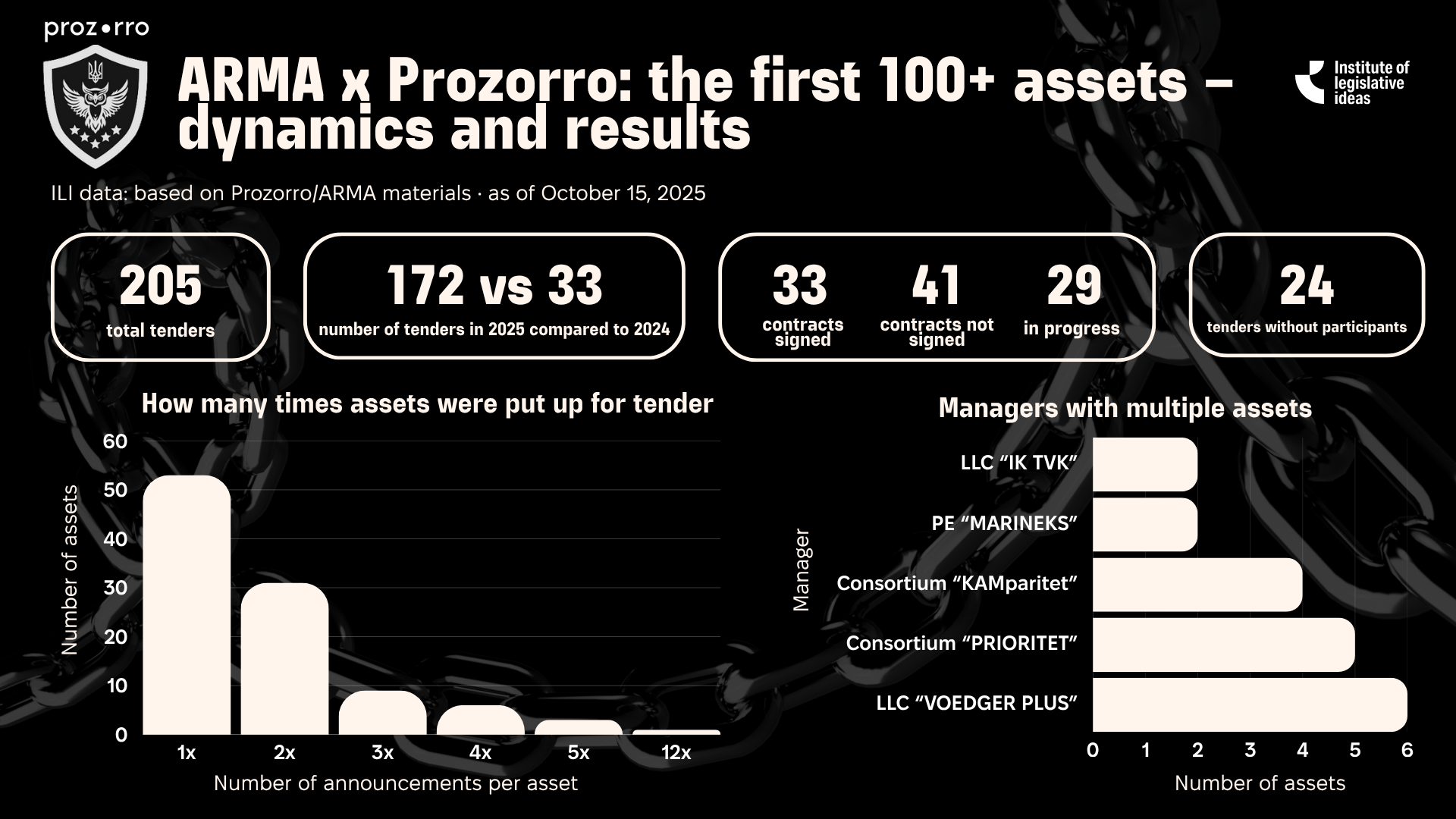

Since the update of the selection procedures for managers, tenders have been announced on the Prozorro platform to find managers for more than 100 unique assets transferred to ARMA. Not all of them have currently gone through the full tender procedure cycle - some are at various stages of consideration, and in most cases, management contracts have not been concluded. Moreover, tenders have been announced several times for some of the assets.

In this report, we have systematized all available information to show the overall dynamics of the process and the main trends, and we have also formed analytical conclusions based on the results of the tenders.

- Number of unique assets for which tenders have been announced on Prozorro - 103

- Total number of tenders announced as of October 15, 2025 (including repeat tenders for the same asset) - 205

In many cases, tenders are announced repeatedly. This happens due to the lack of tender participants or the rejection of proposals submitted by managers. Tenders for assets have been announced twice, three times, and sometimes five and eight times. At the same time, repeated announcements of a tender do not increase the likelihood of its successful completion. More details on this will be provided below.

Key Findings

- Distribution of announced tenders by year:

- Number of tenders announced in 2024 - 33.

- Number of tenders announced in 2025 - 172.

The dynamics of announcing tenders should be assessed as positive - it turns out that the number of announced tenders has increased almost 5 times. It is likely that ARMA itself was able to streamline internal processes in order to announce tenders more efficiently.

- Number of asset blocks belonging to one asset but put up for tender in different lots - 2

In some cases, different tenders were announced for assets belonging to the same owner. We will explain why this is done below.

A) A block of assets belonging to russian general Valery Kapashin - 12 different lots.

B) A block of assets located in Kyiv and the Kyiv region - 6 different lots.

The official owner of the seized real estate is Stichting Administratiekantoor LVV, which owns the real estate of the family of former Interior Minister Vitaliy Zakharchenko.

A single asset transferred to ARMA for management may include various types of property, from real estate to corporate rights or land plots. To make management more efficient, the Agency sometimes divides such assets into several tenders, mostly by type or location of the property.

Such segmentation is a justified management practice, as it reduces the risks of inefficient management of large and geographically dispersed assets, as well as simplifies the search for a manager.

- Assets for which several tenders with different expected values have been announced simultaneously - 1

There was a case (real estate located at: 119-A V. Lobanovskyi Avenue, Kyiv) where several tenders with different expected values were announced simultaneously (UAH 283,300.00, UAH 270,000.00, and UAH 250,000.00).

This practice is new for ARMA and was first applied on October 14. This may indicate adjustments to the conditions for attracting managers or inaccuracies in the valuation of assets. Such situations require greater standardization of approaches to determining value and publishing data on the Prozorro platform.

- Tenders that led to the management agreement - 33

Categories of assets under management agreements:

- Corporate rights - 4 (Ovrutskyi shchebenevyi zavod, Ukrainska yahoda LLC, Ukrtranspnevmatyka LLC, VENTA.LTD LLC);

- Real estate - 16 (6 of which belong to russian general Valerii Kapashin), including: real estate owned by legal entities, Poliana sanatorium, Soniachne Zakarpattia sanatorium, land plots, Zhovtnevyi palats, Budynok Profspilok, SC Flahman, non-residential premises);

- Movable property - 13 (mainly railway wagons, vessels, cars, movable property of the sanatorium, and electronic equipment).

This distribution demonstrates a shift in ARMA’s focus toward more tangible and liquid asset categories that have a faster potential to return economic benefits to the state. It is also likely that the time and human resources required to conduct tenders are lower than in the case of more complex assets.

- Unique asset managers administering multiple assets - 5

Asset management is gradually becoming concentrated among several key players that demonstrate the highest level of activity in tenders:

- CONSORTIUM «Upravliaiucha Kompaniia «KAMparitet» - 4 (SC Flahman, Budynok Profspilok, Ukrainska yahoda LLC, non-residential premises in Kyiv);

- PP «MARINEKS» - 2 (vessel EMMAKRIS III and an asset consisting of 9 vessels);

- LLC «Voyedzher Plius» - 6 (all belonging to the russian general Valerii Kapashin);

- CONSORTIUM «Upravliaiucha Kompaniia «Pryorytet» – 5 (railway wagons);

- LLC «Investytsiina Kompaniia «TVK» – 2 (Poliana sanatorium, Soniachne Zakarpattia sanatorium).

This trend indicates a limited circle of asset managers willing and capable of working with assets that have a complex structure or other problematic aspects. Moreover, ARMA’s tenders have not yet gained sufficient prominence. Scandals involving already selected managers (KAMparitet) also undermine trust in the tenders. This issue should be resolved through ARMA’s reform. However, new procedures have not yet come into effect, and therefore we cannot speak about their effectiveness.

Even at the stage of adopting the Law, we submitted our comments on the procedure, not all of which were taken into account. Therefore, we will continue monitoring the tenders and providing our recommendations.

- Number of assets for which a management agreement was concluded but a repeated tender was announced due to recognition of ineffective management - 3

Assets:

- vessel EMMAKRIS III;

- 9 vessels;

- SC Flahman.

There is currently no public information on the termination of the contracts. At the same time, based on our data, management under these agreements was recognized as ineffective. In this regard, new tenders for selecting a manager have been initiated. Once a new manager is selected, the contract with the previous manager will be terminated and a new one will be concluded. The purpose of such actions is to ensure continuous operation of the asset and avoid downtime.

This demonstrates that ARMA is developing a proactive practice of promptly responding to situations where management results do not meet expectations. In addition, ARMA is ready to terminate agreements if management is ineffective.

- Number of terminated management agreements - 2

On 14 July 2025, two management agreements for movable property were concluded with Consortium «Upravliaiucha Kompaniia «Pryorytet» - specifically concerning three diesel locomotives and one hundred railway freight wagons.

On 23 September 2025, both agreements were terminated by mutual consent of the parties. In the case of the 100 railway freight wagons, the reason for termination was the lifting of the arrest of these assets. In the case of the three diesel locomotives - circumstances occurred that hindered and/or made it impossible for the manager to properly fulfill the contractual obligations for reasons beyond the manager’s control, which could not have been foreseen prior to the conclusion of the agreement.

This practice demonstrates the flexibility of ARMA’s mechanisms and its ability to respond to changes in the legal status of assets without violating procedures.

- Number of assets for which tenders were announced only once - 53

Management agreements concluded (i.e., agreement was concluded immediately) - 13

No agreement concluded - 40

- Almost half of the assets (50 out of 103) have undergone a repeated tender procedure.

Among them:

- 31 assets were tendered twice;

- 9 assets - three times;

- 6 assets - four times;

- 3 assets - five times;

- 1 asset - twelve times (in some cases, an asset is announced for tender as a single block, while other times - separately by the individual assets included in it).

These data indicate both a high level of procedural complexity and a low attractiveness of certain assets, which may be due to their legal status, geographical location, or technical/physical condition.

- Number of assets for which no participants applied to tenders (including repeated tenders) - 24

This indicator highlights the limited demand for certain categories of arrested assets and suggests the need to develop additional incentives or mechanisms to attract new market participants.

- Overall results of tenders for 103 unique assets:

- Tender successfully completed (agreement concluded) - 33

- Tender unsuccessful (no agreement concluded) - 41

- Tenders still ongoing (at the stages of winner qualification or proposal submission) - 29

Conclusion

The growing number of tenders in 2025 indicates increased activity of the Agency and the asset management market.

At the same time, the significant share of repeated tenders and the lack of participants for certain assets highlight the limited capacity of the market, the low attractiveness of some asset categories, or insufficient flexibility of tender conditions. Repeated announcements following the recognition of ineffective management demonstrate proper oversight and the system’s ability to self-correct.

Going forward, key priorities should include expanding the pool of asset managers, optimizing tender procedures, and improving the efficiency of seized asset utilization. In addition, the implementation of new procedures in line with the updated ARMA Law is essential. Their successful application will determine the future popularity and effectiveness of tenders for selecting asset managers.